Why Use AI Trading Bots?

In recent years, the use of AI trading bots and AI trading software has been on the rise. These advanced tools have revolutionized the way people approach trading, allowing for increased speed and accuracy in decision-making. But why use AI trading bots and software? The answer is simple: it provides traders with a competitive edge. By utilizing cutting-edge algorithms and predictive models, these tools are able to quickly analyze vast amounts of data and make informed trading decisions in real-time. This results in better trade execution, increased profitability, and a more efficient use of time. In this page, we will explore some of the top AI trading bots and AI trading software available today and review their features, benefits, and limitations to help you choose the right tool for your trading needs.

1. Trade Ideas

Overview

Trade Ideas is an AI-powered stock trading software that provides a trading platform for investors of all experience levels, with dozens of investment algorithms to ensure users improve their trading. It offers prebuilt AI trading management technologies for intermediate traders and the ability for experts to fully customize their trade strategies and leverage AI to improve on them. The software also provides Full Quote Windows, which displays fundamental data in an easy-to-understand format, and custom layouts for channels. Trade Ideas is considered one of the leading tools for experienced investors in the stock market, providing real-time alerts, testing investing hypotheses, and generating trade ideas. The software is designed for day traders and provides unique functionalities and features, including powerful tools to look for assets that are temporarily showing abnormal technical signals. Trade Ideas also offers in-depth guides on how to use the platform through TI University. Founded in 2003 by financial technology veterans, Trade Ideas has accomplished what no human can by watching each trade of every stock in the market and notifying users about profitable activity. The software is best for active US day traders seeking real-time AI-driven high probability trades, excellent stock scanning, and a live trading room to learn trading techniques.

Key Features

- Artificial Intelligence Algorithms: Trade Ideas uses advanced algorithms based on AI to analyze and interpret large amounts of data quickly and accurately.

- Simulated Training: The app provides a simulated trading environment that allows users to practice their trading strategies without risking real money.

- Suggested Entry & Exit Signals: The premium plan includes “Holly AI,” which uses statistical patterns and backtesting technology called “Oddsmaker” to provide users with suggested entry and exit signals.

- Full Quote Windows: The app provides full quote windows that allow users to view detailed information about a particular stock, including charts, news, and fundamental data.

- Custom Layout: Trade Ideas is highly customizable, allowing users to personalize their trading experience to suit their needs and preferences.

- Risk and Reward Levels: Every time users access the Trade Ideas chart, the app presents them with “risk and reward” levels based on their settings and average buying behavior, helping them to make informed decisions.

- Stock Racing: Users can watch up to 10 or 20 stocks simultaneously to compare their performance visually over time, enabling them to get a full picture of the market.

- Compare Count: The app provides a “Compare Count” feature that gives users real-time feedback on which strategy is working best, helping them to make clearer decisions.

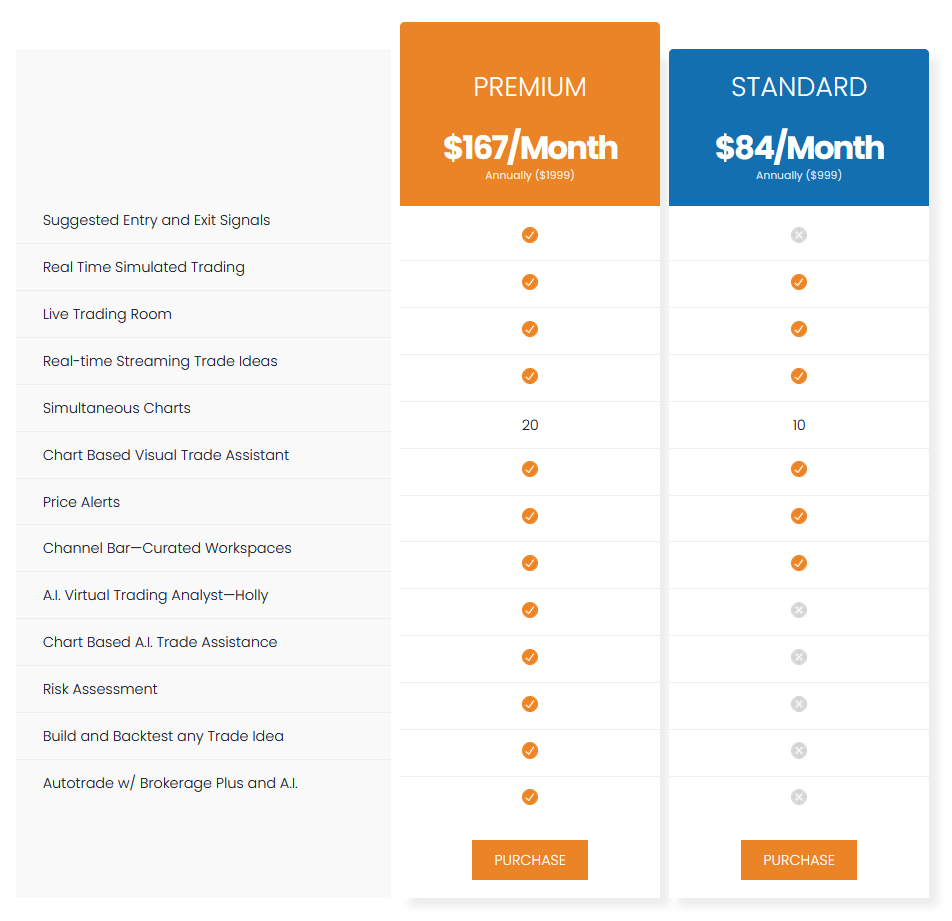

Pricing

Pros and Cons

Pros

Cons

Bottom Line

Trade Ideas is a comprehensive trading platform that caters to the needs of both novice and experienced traders. Its AI-powered scanners and trading signals are unmatched in the market, providing traders with real-time insights into potentially profitable trades. The platform’s sophisticated algorithms, coupled with its customizable scanners and educational modules, make it a must-have for traders seeking to maximize their profits. While it may take some time for beginners to get used to all the different tools, the platform’s advanced features make it a better choice than trial and error trading. Trade Ideas provides traders with high-quality signals and trade ideas, as well as outstanding AI capabilities. Overall, Trade Ideas is an excellent tool for active day traders searching for the best trade opportunities.

2. Tickeron

Overview

Tickeron is an AI-powered platform that offers advanced trading options for investors of all skill levels. Developed and maintained by SAS Global, the world’s largest provider of business intelligence, Tickeron provides a coordinated quant-sourced marketplace for both investing and trading services. The platform is designed to integrate both human and artificial intelligence to offer exceptional advisory services. With a focus on AI trend forecasting and customisable confidence levels, Tickeron’s proprietary algorithm, the Tickeron Pattern Recognition Engine (TPRE), provides timely recommendations and in-depth analysis for popular stocks, currencies, and commodities. In this context, we will explore Tickeron’s key features and how they can benefit traders and investors.

Key Features

- Tickeron offers AI trend forecasting, AI active portfolios, customizable pattern search criteria, AI robots, and customizable confidence levels to facilitate trading with the right stocks.

- The platform scans stocks, futures, and forex for the most promising opportunities in terms of risk/reward ratio and probability of success, provides market outlook and technical analysis tools, and allows users to analyze the views of fellow traders regarding a particular stock or index.

- The AI Robots feature provides a sophisticated robot service to minimize the number of trades users make to a rational amount by evaluating different patterns and calculating average profits and losses.

- The Trend Prediction feature uses a complex algorithm to analyze market data and price patterns to find the right trading opportunities, and users can customize the feature to their investment style.

- The paper trades exchange and watchlist exchange allow users to exchange their paper trades and track specific exchanges based on their investment ideas, respectively.

- The AI-powered pattern search engine is a paid feature that covers thousands of stocks, ETFs, and cryptocurrencies to calculate price triggers, target levels, and probability.

- Tickeron offers AI model portfolios, active portfolios, and model portfolios, all powered by AI software or ideas from the community, for hedge fund-style investing in various stocks and ETFs.

- The trader clubs and top predictors features allow users to share their thoughts and opinions on future opportunities and provide input and prediction on what will happen in the crypto world, respectively.

- Tickeron also provides paper trades to test different trading strategies without using real money, stock news and signals based on the indicators users set, and an AI-powered screener to find the best available trade ideas customized to different trading strategies.

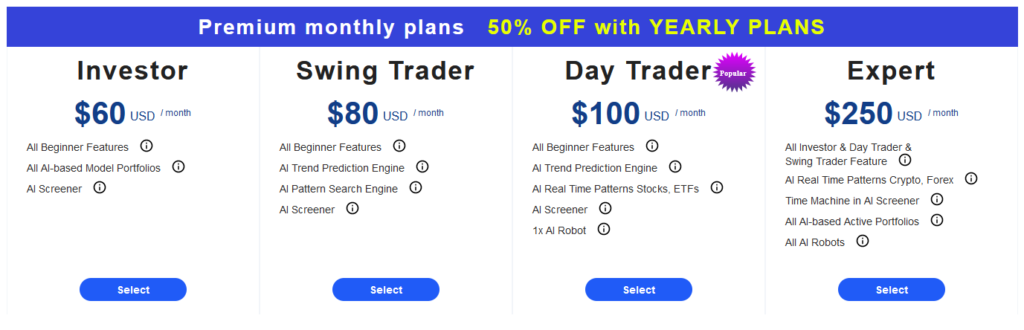

Pricing

Pros and Cons

Pros

Cons

Bottom Line

Tickeron is a fantastic platform that offers an array of useful advisory tools and services to investors, traders, and service providers. With the help of AI intelligence and human knowledge, Tickeron has optimized investing performance and has become a valuable resource for self-directed investors. Although nothing can replace human intelligence, Tickeron’s cutting-edge market intelligence and AI-powered screens are some of the best out there. It’s a game-changer for beginner traders who can easily incorporate advanced techniques into their trading routine with minimal effort. We highly recommend Tickeron to anyone looking for advanced trading tools.

3. TrendSpider

Overview

TrendSpider is a stock market platform with a unique machine learning algorithm that provides advanced automatic technical analysis for traders. It offers various tools to help identify trends in the forex market and make effective and profitable trades. The platform’s Trading Bots can automate trading strategies and trigger specific events when certain conditions are met. The platform is highly customizable and flexible, allowing traders to match their exact strategy, work on any timeframe, and powered by a cloud-based system. Additionally, TrendSpider offers scanning and screening for better trade setups, smart charts, dynamic price alerts, and more. The platform caters to various assets in the market feeds and provides automatic technical analysis and customized alerts when certain movements take place. TrendSpider is an innovative software company founded in 2016 by Dan Ushman and is reputable among high-frequency trading professionals, swing traders, day traders, and technical traders. To begin using TrendSpider, traders can sign up for a free trial on the TrendSpider website, which offers plenty of educational options to deal with the learning curve.

Key Features

- TrendSpider supports trading bots that can be used to execute trades based on custom indicators or patterns

- It allows for simple backtesting of trading strategies over any timeframe and market

- It offers Raindrop Charts, an alternative to candlestick charts, which provide more information on trading volume during a given period

- It helps traders find opportunities quickly by providing alerts for breakouts and bounce setups and by detecting trendlines, Fibonacci patterns, and candlestick patterns on multiple timeframes

- Its Options Flow Scanner tracks directional trades like block trades or options sweeps, potentially pointing to big opportunities

- Automated drawing tools, including trendlines, Fibonacci retracements, and Andrews’ pitchforks, work seamlessly with the Algo Charting Engine

- The software automatically draws trendlines and retracement lines, making the process more precise and time-efficient

- It offers dynamic price alerts based on quantifiable data sets and multi-timeframe analysis, making it easier to analyze multiple timeframes

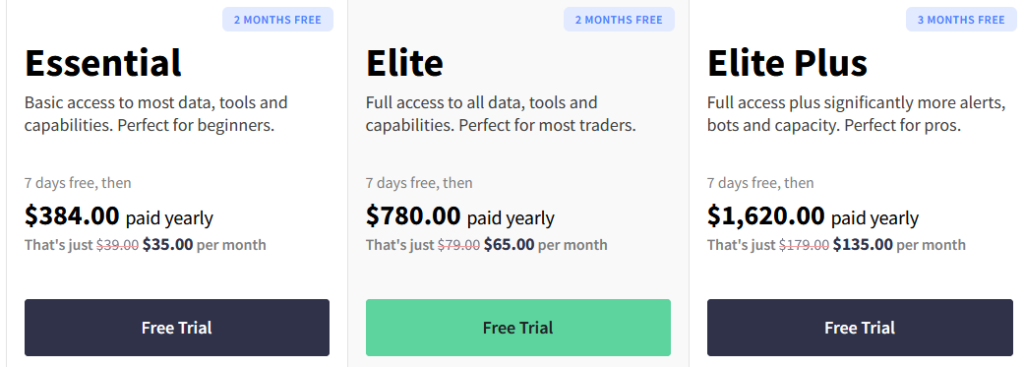

Pricing

Pros and Cons

Pros

Cons

Bottom Line

TrendSpider is a reliable and innovative analysis software and chart platform that offers traders an efficient way to track price movements, analyze data, and make informed trades. The platform’s machine learning algorithm makes it easier to spot trends and make winning trades using various technical indicators. With its abundance of trading opportunities, multi-chart viewing layouts, and customizable settings, TrendSpider is an excellent tool for traders of all levels. The customer support is excellent, and you can always chat with a human whenever you need assistance. The pricing is reasonable, and the platform offers automated trendlines with market intelligence that is highly accurate. Although the platform is relatively new and still refining and adding features, I see a bright future for TrendSpider, with exciting innovations on the horizon. Overall, TrendSpider is a top-notch platform that can significantly enhance a trader’s ability to interpret price and make profitable trades.

4. Scanz

Overview

Scanz is a powerful all-in-one market scanning platform designed for day traders and swing traders. It offers a comprehensive filter criteria, custom filters, breakout alerts, tabbed windows, and more to take your day trading to the next level. With Scanz, users can scan a combination of over 100 price, volume, technical, and fundamental variables in real-time. Moreover, the platform provides users with a real-time newsfeed and stock screening application that scans and screens the entire U.S. stock market. Scanz is known for its fast and reliable data and news updates, real-time trading signals, advanced charting features, and access to real-time Level II data.

Key Features

- Scanz Trading offers Chart Montage functionality, which provides real-time streaming news, level 2 data, including time and sales, and Dollar Volume data.

- Scanz offers integrations with brokers like TD Ameritrade and Interactive Brokers for direct trading from the charts.

- Scanz Scanning and Screening lets you scan entire markets for liquidity and volume patterns to find volatility for day trading.

- Scanz Charting covers all the important chart patterns and chart indicators for technical analysis screening.

- Scanz’s Scanner offers a multitude of features, including fundamental, liquidity, and technical filters with video tutorials provided, drawing tools, information from bankrupt stocks, and even data export.

- Scanz’s News Streamer sources news from 60+ news providers and 50+ blogs with pre-built scan options for finding relevant information fast.

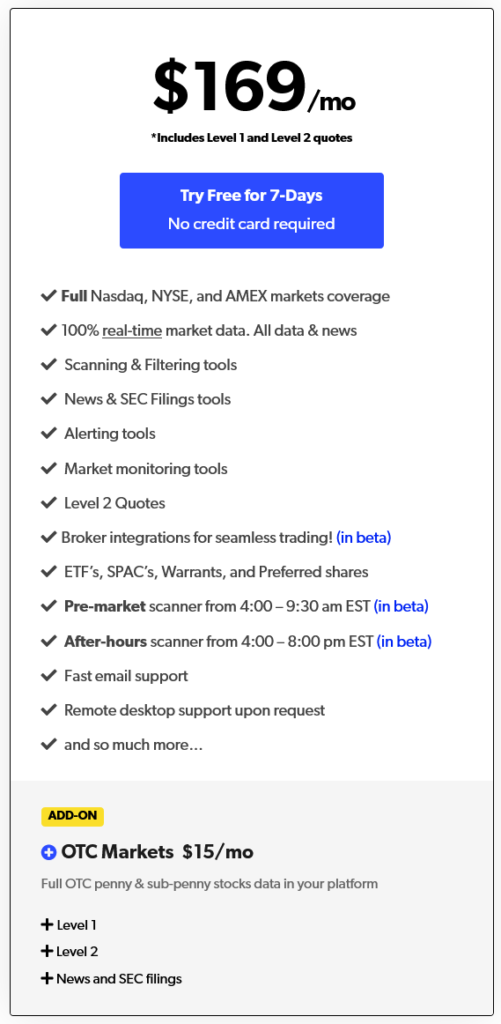

Pricing

Pros and Cons

Pros

Cons

Bottom Line

Scanz is a powerful tool for experienced traders that provides Level I/II streaming data, real-time news scanning, and trade signals, making it an excellent platform for day trading. The platform consolidates all relevant trading news and information, saving traders valuable time. While the monthly fee is high, the platform is well worth the investment for traders who are already skilled in their craft. With its highly intuitive design and free training, Scanz is an awesome stock screener and scanner that is sure to help traders increase profitability and minimize losses. Overall, we highly recommend Scanz to any experienced trader looking to take their trading game to the next level.

5. Black Box Stocks

Overview

Black Box Stocks is a software platform that provides real-time stock and options scanning functionalities to monitor market activities with the help of artificial intelligence and algorithms. It was founded in 2011 by Eric Pharis and is based in Dallas, Texas, with data servers located close to the NYSE, NASDAQ, and OTC exchanges. The software is designed for both beginners and professionals with features such as dark-pool activities scanning, private discord channels, and Twitter groups for real-time stock and trade options. Black Box Stocks offers an easy-to-use dashboard with real-time alerts, stock scans, news feeds, interactive charts, and a social media platform for its subscribers. The software uses high-frequency trading strategies and analytics based on pre-market, market, and post-market hours to identify actionable stock trade alerts. The Black Box Stocks system is surprisingly user-friendly and easy to jump into, and its subscription plan is comprehensive, covering all its services. The software is quality-oriented and considered a reliable and trustworthy trading platform for individual traders.

Key Features

- Black Box Stocks uses AI and algorithms to provide a stock screener solution and filter noise out of the market

- It analyses real-time data to come up with real-time based trading alerts

- The software deep scans the market for dark-pool activities

- It provides access to private Discord channels and Twitter groups for real-time stock and market state

- The proprietary stock screener combines market data with advanced AI algorithms

- The stock screener allows the user to choose a group of stocks to analyze by selecting all stocks, Nasdaq only, or NYSE/AMEX only, or by using price per share as a filter

- The scanner result layout includes a chart, top 10 gainers, volatility indicator, real-time news, alert log, alert stream, and more

- The charting tool is highly customizable and contains institutional-grade charts with the ability to switch between bar, line, and candlestick charts and add studies

- The BBS news feed provides a constant stream of news to keep up with the latest fintech news and major company announcements

- The software allows for easy replication of trades

Pricing

Pros and Cons

Pros

Cons

Bottom Line

In conclusion, Black Box Stocksis a powerful and user-friendly platform that offers advanced data analysis tools and algorithmic features to help traders succeed in the stock and options markets. Its proprietary Black Box Stocks System can scalp valuable information much more quickly than any human, making speed a priority for trading success. The platform includes a plethora of educational materials covering almost everything traders could imagine when it comes to trading stocks online. Additionally, all subscriptions include free access to the Blackbox Bootcamp Class, which provides plenty of useful advice on stock and options trading. With a monthly subscription, traders can test out all of the software’s features and decide if it truly adds value before making a full commitment. Black Box Stocks is a market leader when compared with similar stock trading platforms, thanks to its education, community, and overall comradery. Once traders become comfortable using it, they’ll notice that it can be a great stock screener to add to their list of tools.